This expense organizer is PERFECT for the home-based business owner or direct sales con… | Business expense, Business organization, Business organization printables

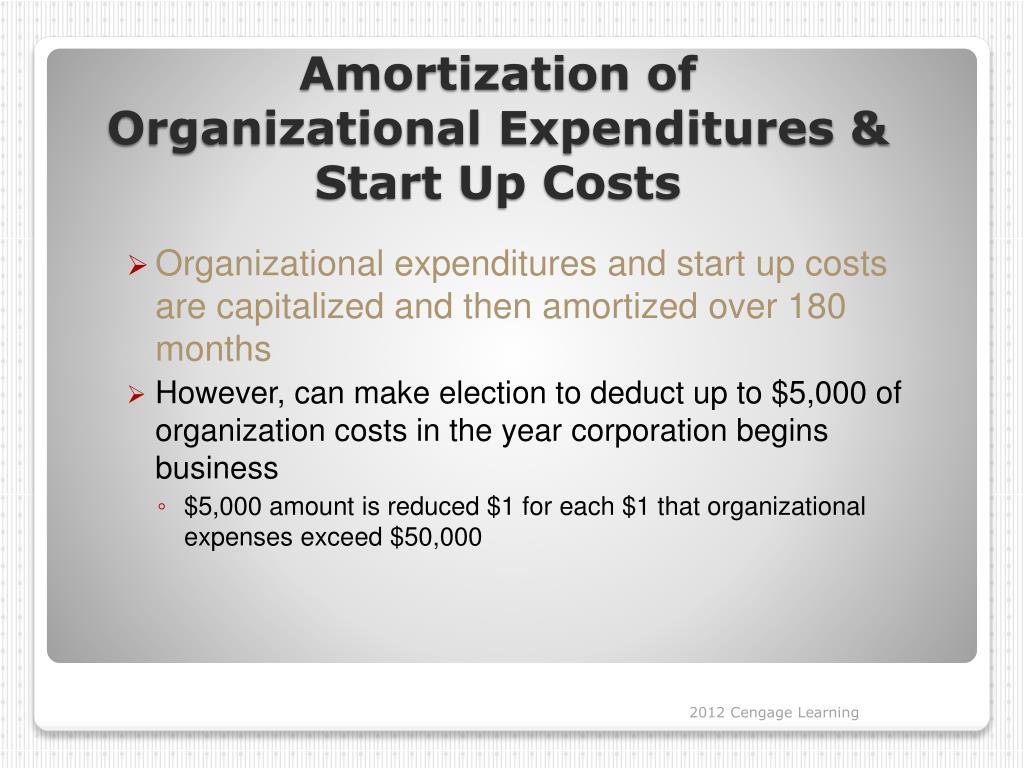

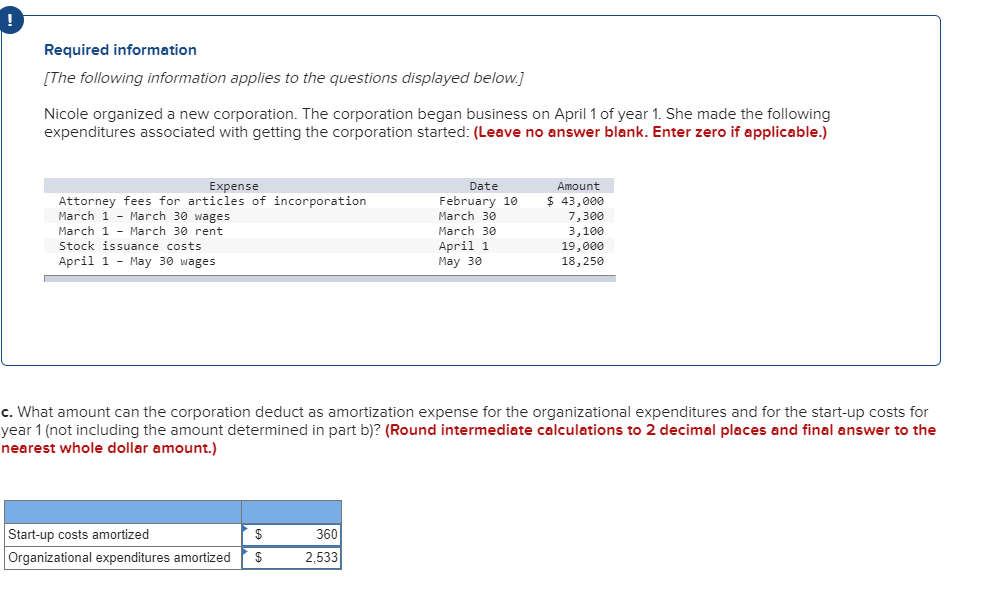

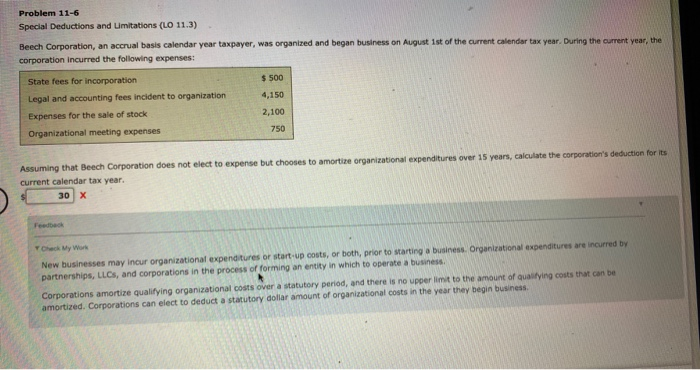

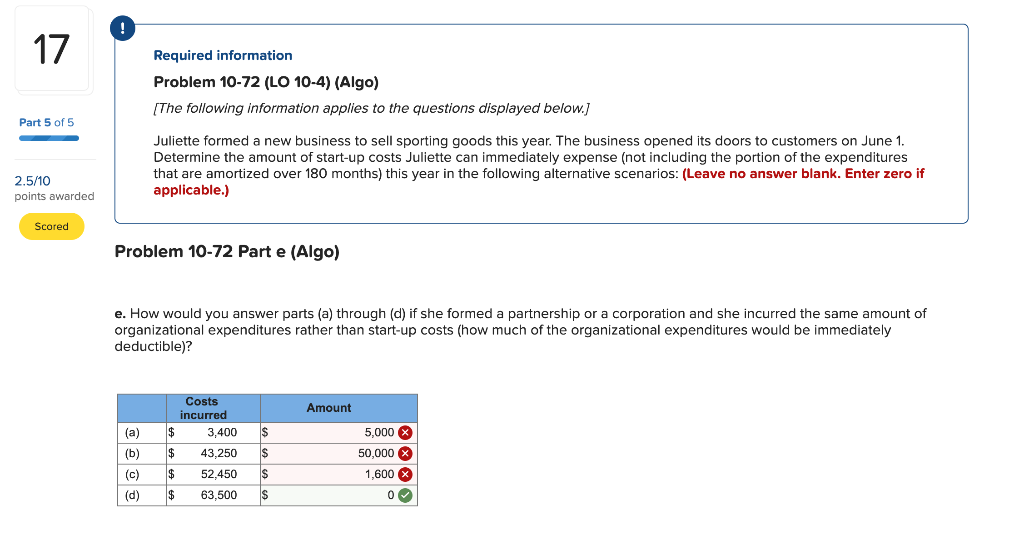

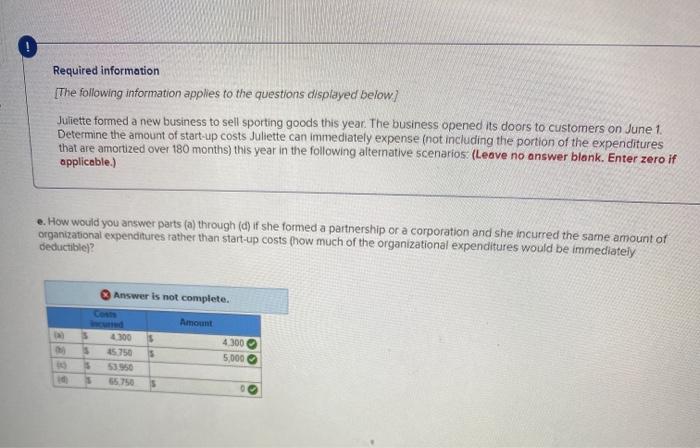

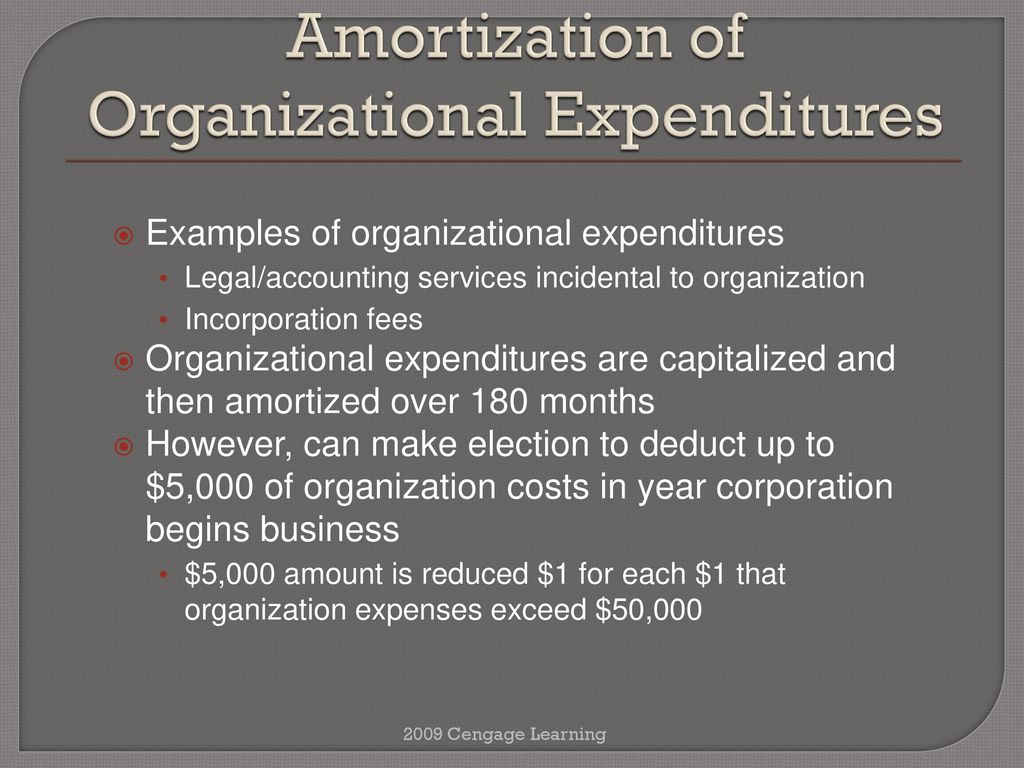

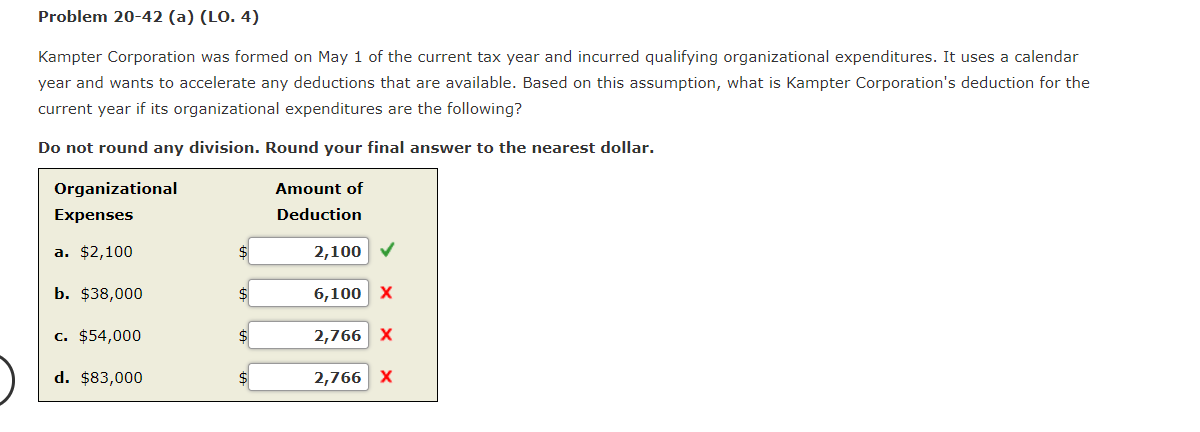

Lesson 2.2.4 Organizational Expenditures Deduction: Applications - Module 2: Corporate Income Taxation | Coursera